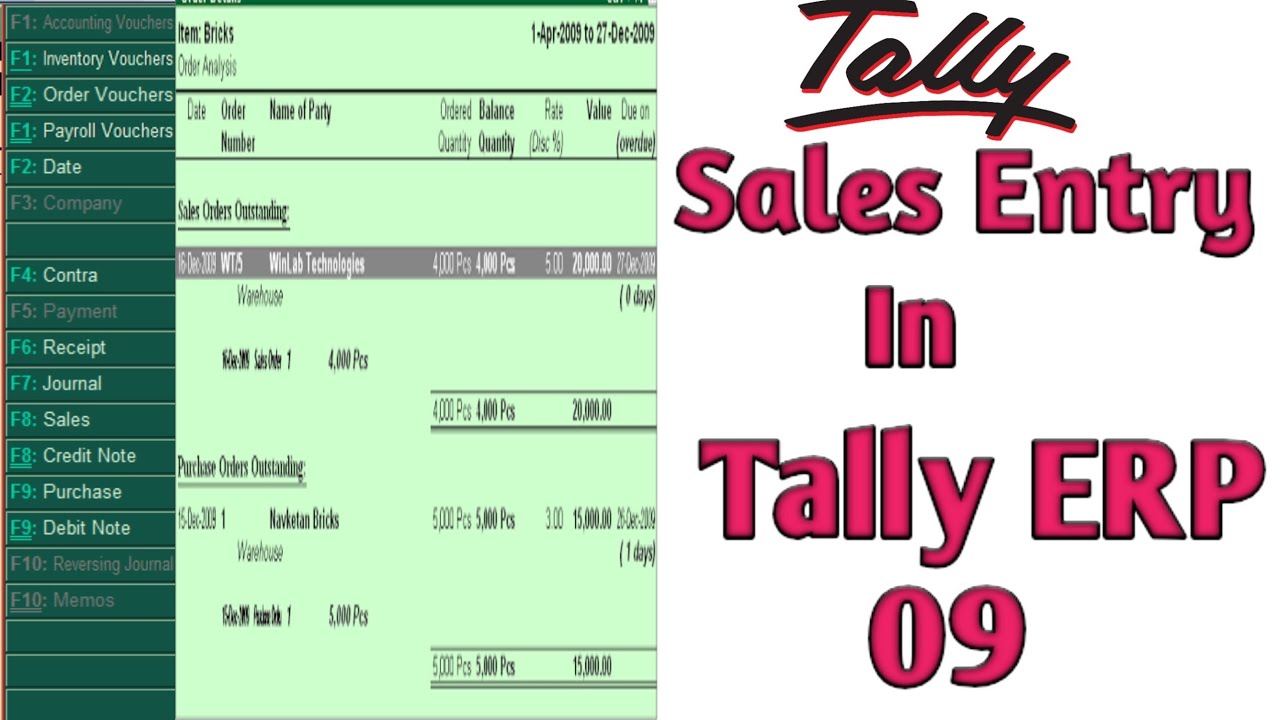

Sales Entry in Tally ERP 09 clearly explain step by step YouTube

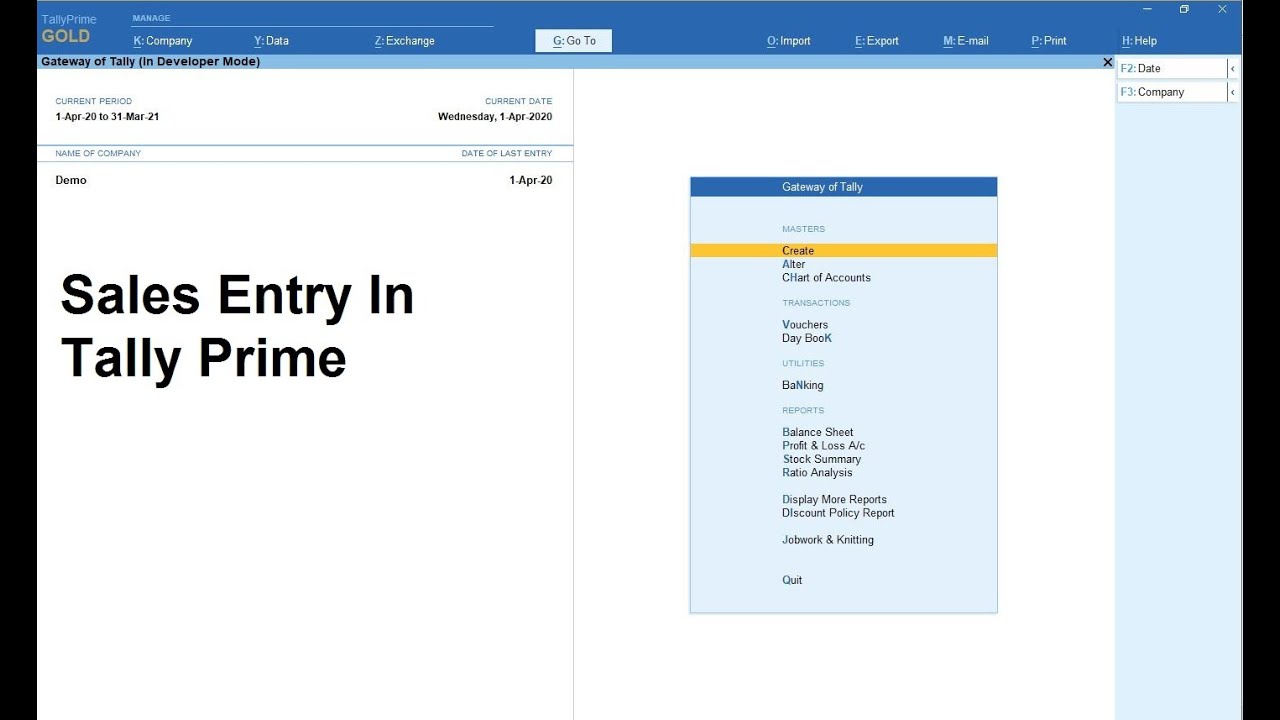

Purchase Entry in Tally Prime 2024: Voucher, Accounting, Item Invoice Method October 4, 2023 What is Proforma Invoice? Meaning, Format, Template 2024 December 5, 2023 Sales Entry in Tally Prime 2024: Item, Voucher, Accounting Invoice Method Published by Sanchit Singh at Last Updated on December 26th, 2023 at 1:23 pm Published on October 5, 2023

Tally erp.9 Input & Output Tax Transactions, Purchase & Sales Entry YouTube

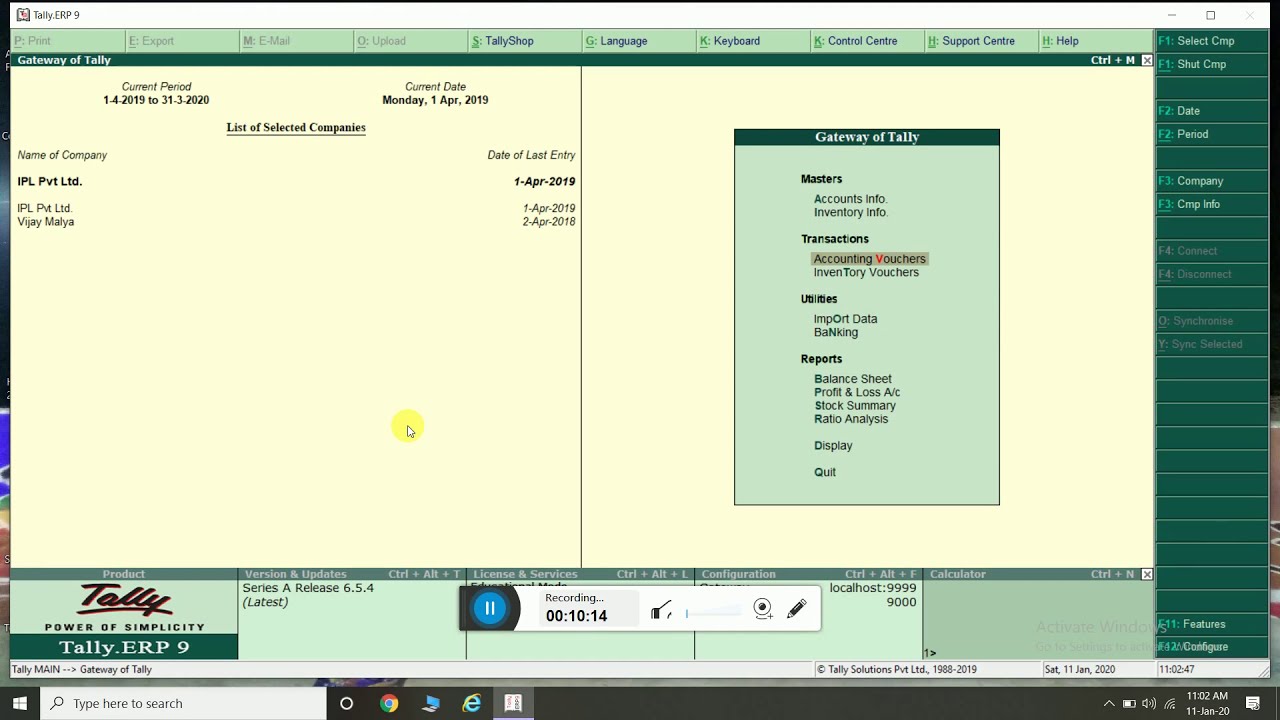

You can record a transaction with the following steps. A transaction for payment of rent (expenses) is used as an example. Press Alt + G (Go to) > Create Voucher > press F5 (Payment). Alternatively, Gateway of Tally > Vouchers > press F5 (Payment). Press F2 (Date) to change the transaction date, if needed.

GST in Tally.ERP 9 Accounting Methods

learn step by step !!SALES & PURCHASE ENTRIES IN TALLY.ERP9

Auto Sales Entry in Tally ERP.9 YouTube

Purchase & Sales entry in Tally Prime with GST | How to Pass Sales & Purchase entry in Tally Prime Asdo Classes 507 subscribers Subscribe Subscribed 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8.

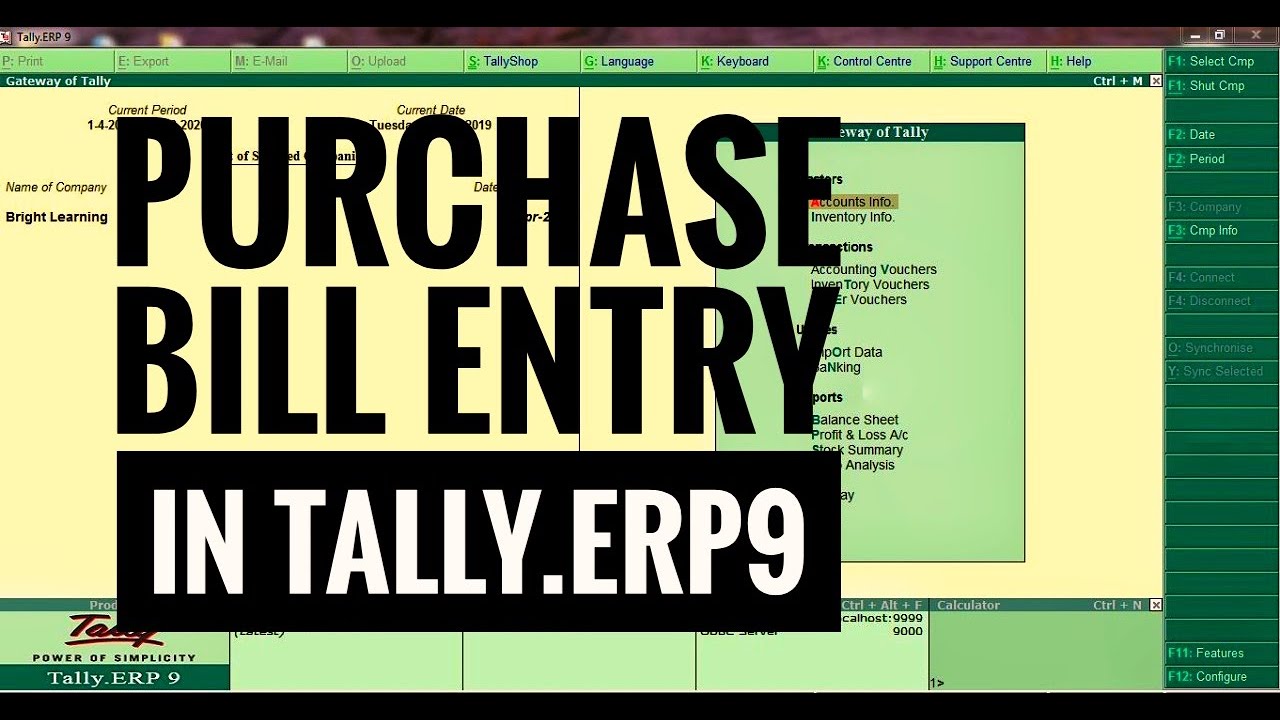

Purchase Bill Entry in Tally.ERp 9 (GST) YouTube

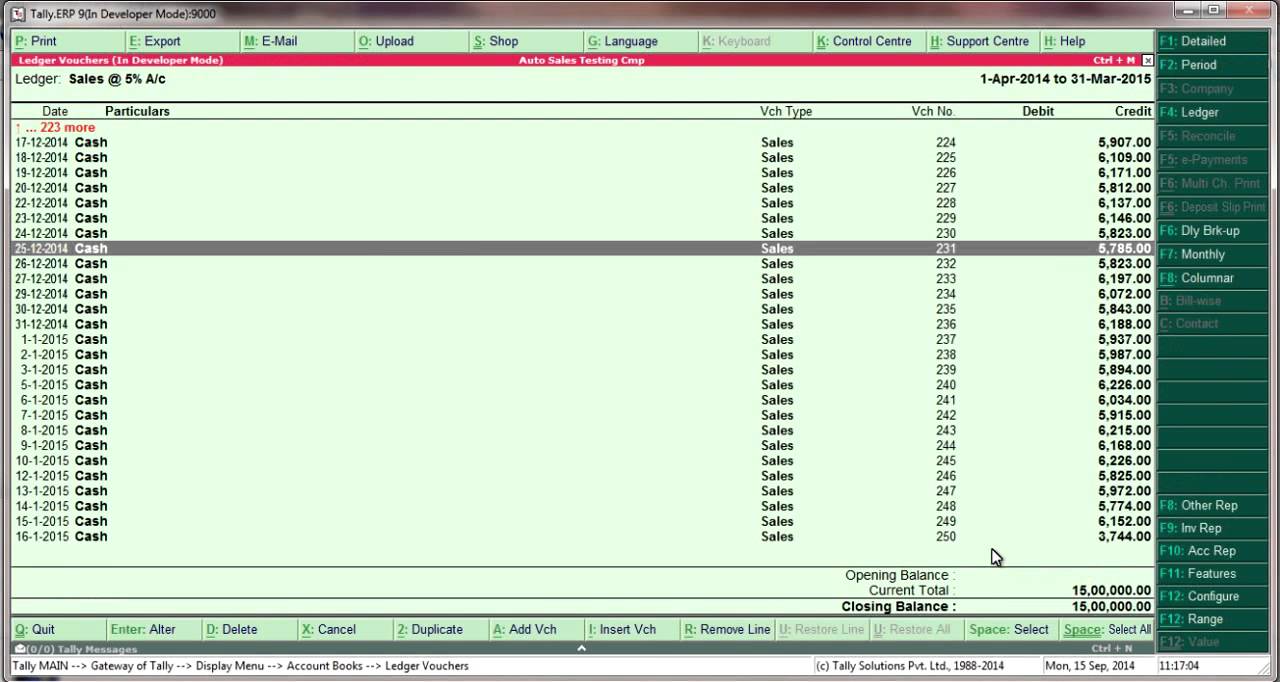

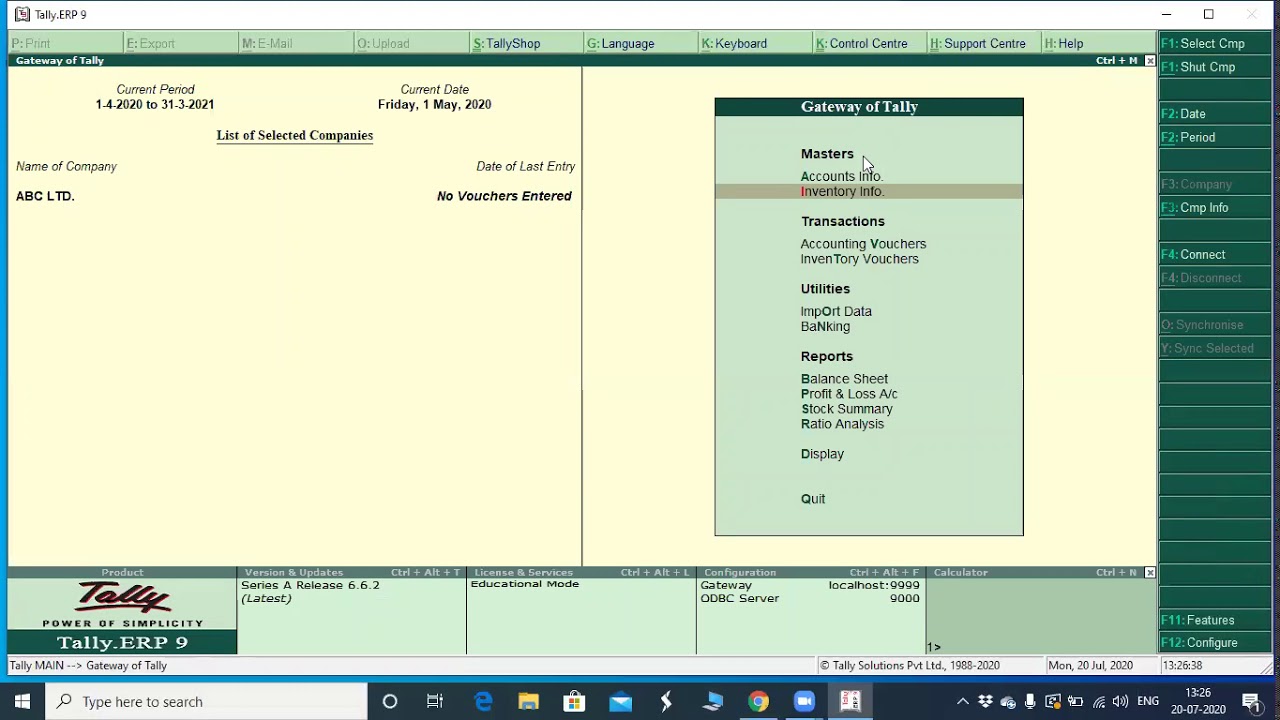

ERP 9 is a software suite that includes finance, accounting, inventory, point of sale, sales and purchase, manufacturing, payroll, costing, and branch management, as well as TDS, TCS, Excise, and GST compliance features. This article particularly elaborates on sales entries in Tally. What is a Voucher in Tally?

How to Pass Purchase & Sale Entry with GST Passing Entry in Tally

Go to Gateway of Tally > Select Vouchers > press F9 to open the (Purchase) screen. Or you can also press Alt+G (Go To) > Create Voucher > press F9 (Purchase). Now Press Ctrl+H (Change Mode) to select the required voucher mode ( Item Invoice) To pass Purchase entry with GST: Select the shared purchase ledger during the transaction.

Sales Entries in Tally Prime Tally Prime guide YouTube

How to record sales and Purchase Transaction Sales and Purchase entry with GST Tally.ERP9.Purchase Entry With GST in Tally, Sales and Purchase entry with GST.

How to Pass Purchase and Sale Entry with GST in Tally Prime

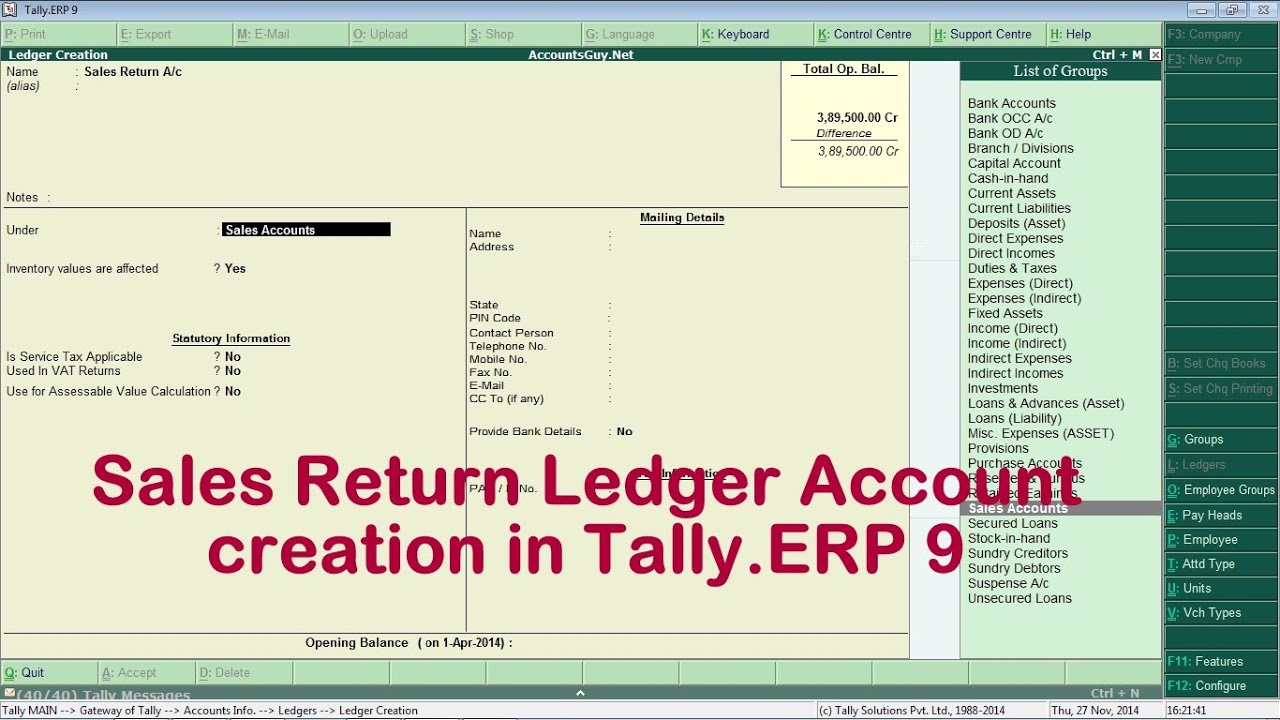

If the Place of Supply is the same as your company states then the sales transaction is recorded as a local supply of goods. To record the tax for local sales, you must use the CGST and SGST ledgers. Open the Sales Voucher in the Item Invoice mode. Press Alt+G (Go To) > Create Voucher > press F8 (Sales).

HOW TO DO BASIC SALE PURCHASE ENTRY IN TALLY PART 1 YouTube

Creating Sales and Purchase vouchers in Tally is extremely easy and simple. They are often referred to as purchase entry in Tally and sales entry in Tally. Learn how to do it in this video by Attitude Academy Yamuna vihar, Delhi. Sales and Purchase Entry in Tally ERP9 1 of 11 Download Now Save slide Save slide More Related Content What's hot (20)

HOW TO MAKE SALES VOUCHER ENTRY IN TALLY ERP 9 YouTube

Enter Purchase order number Narrator, mode on zahlen Example of Buy Entry with GST stylish Tally ABC is a computer trader. ADD purchased a notebook (for selling) excellence 15000 at credit from a locally seller registered the the same state. GST applicable in the laptop is 18%.

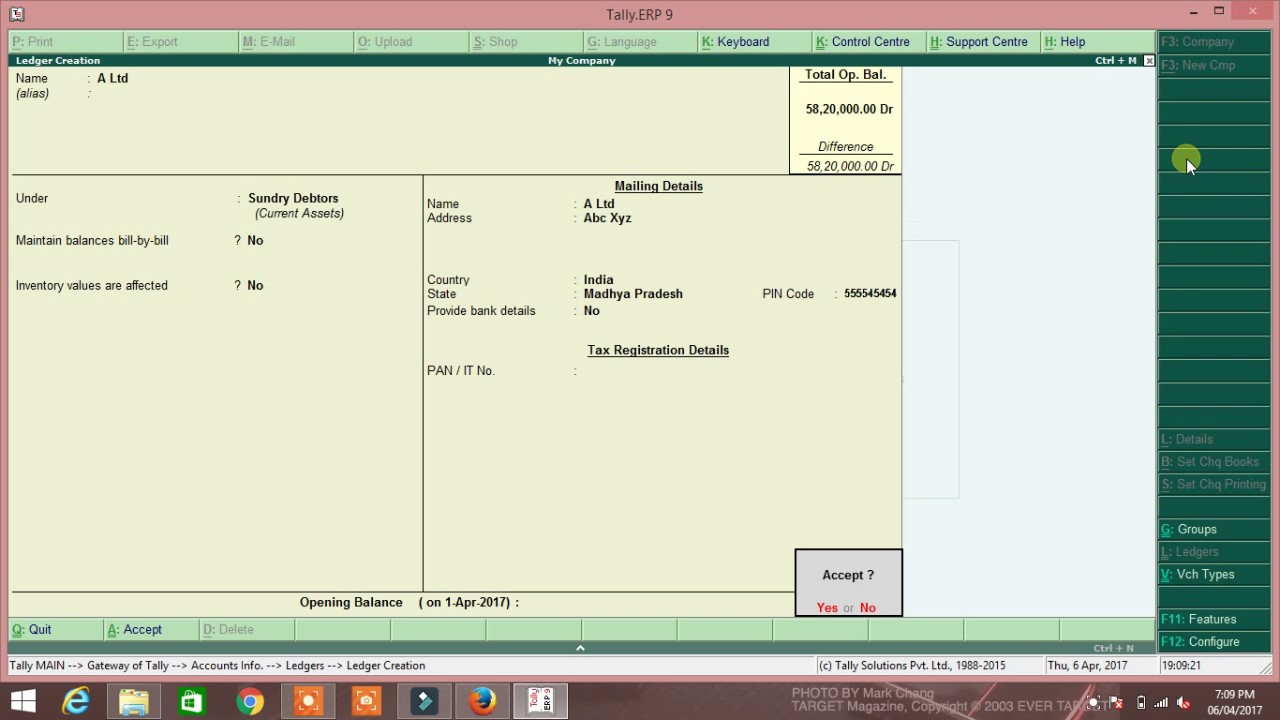

How to record Purchase returns and Sales Returns in Tally Prime ? KodeBinary

Sales of Goods and Services Record Local GST Sales Every business involves sales of goods or services. The sales transactions in your business may be a simple cash sales, or even sales on credit. For each sales transaction, you will need to keep a record of the items that you sold, the payment that you received, goods returned, and so on.

How to Record Shares Purchase and Sales Transactions in Tally.ERP 9 Accounting Education

Sort by: relevance - date. Search 521 Entry Level Sales jobs now available on Indeed.com, the world's largest job site.

Purchase entry in tally with GST in Hindi Tallyadvice

Press Alt + G (Go To) > type or select Day Book > select the required Purchase Order voucher > and press Enter. Alternatively, go to Gateway of Tally > Display More Reports > Day Book > select the required Purchase Order voucher > and press Enter. Press F12 (Configure) > set Provide details to preclose orders to Yes.

sales return entry in tally erp 9 YouTube

Sale and purchase entry in Tally with GST is confusing because there are many factors that the accountants should consider. Inaccurate recording of GST could lead to problems like GSTR-2A mismatch, wrong ITC claims, and a wrong balance sheet. Here is your guide to record sales and purchase entry in Tally accurately.

Purchase Entry Voucher in Tally.ERP 9 l Create Purchase Voucher l Purchase Entry tally

Sales Entry in Tally Prime 2024: Item, Voucher, Accounting Invoice Method October 5, 2023

Purchase Order in Tally Prime

Sort by: relevance - date. Search 28 Entry Level Sales jobs now available in Montréal, QC on Indeed.com, the world's largest job site.